Preparing QuickBooks

What you'll need

Morning Flight generates invoices but doesn't accept payments or track receivables. For that you need an accounting system. In much of the world that's likely to be QuickBooks. So here you are. Two separate programs and the nuisance of having to key in a stack of invoices into QuickBooks every night. Would be nice if you could get the two to talk to each other. Starting with version 14.1 of Morning Flight you can. Here is what you'll need:

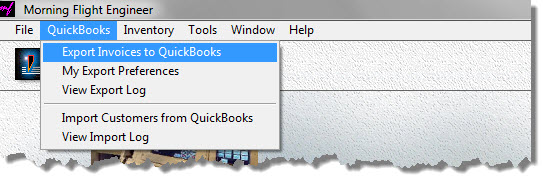

1. Version 14.1 or higher of the Gold or Pixelblitz edition. Why only those two editions? None of the others generate invoices. Versions 14.1 and higher include an expanded Flight Engineer that produces CSV import files of your Morning Flight invoices, mapped for QuickBooks.

2. A commercial import utility such as the Transaction Pro Importer from Baystate. Importing transactions into QuickBooks with the old IIF Files used to be a messy process, often yielding unpredictable results. Fortunately, a number of third party vendors have found a way around the barricades. Foremost among them is Baystate Consulting. Their Transaction Pro 5 Importer now lets us use the same reliable CSV (Comma Separated Values) file format for importing transactions that was used all along for lists.

We don't sell the Pro 5 or get a commission from Baystate. When we developed the new QuickBooks link for Morning Flight, we tested a number of utilities from different vendors. Theirs just happened to come out on top. The program supports 29 different import types in addition to invoices. Baystate advertises an installed user base of 25,000 and has been certified as a Gold Developer by Intuit, the makers of QuickBooks. The Transaction Pro 5 Importer is available directly from Baystate with a perpetual use license. A trial version can be downloaded from the Baystate website.

Those are the requirements for invoices. For transferring a QuickBooks Pro Desktop customer list into Morning Flight, all you need is the new Gold or Pixelblitz version where everything's built in. Exporting lists out of QuickBooks has always been easier and more reliable than transactions, primarily because the exchange of lists is riding on tried-and-true CSV files. With version 14.1, we've automated the second step, importing and merging your QuickBooks customers with those already stored in your Morning Flight file.

What about the reverse, transferring your Morning Flight customer list into QuickBooks? After all, the Pro 5 Importer works for both lists and transactions, so you might be tempted to bulk-import all your customers into QuickBooks ahead of time and be done with it. Not a good idea. For openers, it's unnecessary. The Pro 5 program will piggy-back customer and other relevant list data whenever you import a Morning Flight invoice into QuickBooks. If you're invoicing an existing customer and you've changed their address in Morning Flight, it will be updated in QuickBooks automatically.

Second, you may have built up a customer list in Morning Flight for a while, and that list will include folks who asked for quotes but never bought anything. Your list could probably stand a little pruning anyway, so why drag all that baggage into QuickBooks?

![]()

The Harry Smith you have on file in QuickBooks is not the same customer as Harry Smith & Co. in Morning Flight. To keep duplicates from sprouting up in QuickBooks, double check the names in both programs to make sure they match.

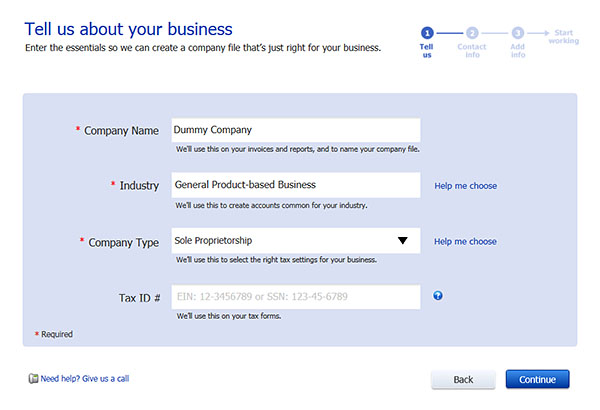

Creating a Dummy Company in QuickBooks

To avoid putting your active company file at risk, let's first set up a dummy company so we have a sandbox to practice in. That's actually one of the easier things to do in QB, and "Dummy Company" is as good a name as any. You could use one of the QuickBooks sample files, but those come preloaded with a bunch of stuff that will only get in the way.

1.Open QuickBooks, then go to File > Close Company.

2.Select File > New Company and click Express Start.

3.Enter a fictitious Company Name, then click "Help me choose" for Industry and Company Type. Ignore the Tax ID.

4.Bypass "Contact Info" on page 2.

5.Ignore all the Add buttons on page 3 and click "Start Working" at the bottom.

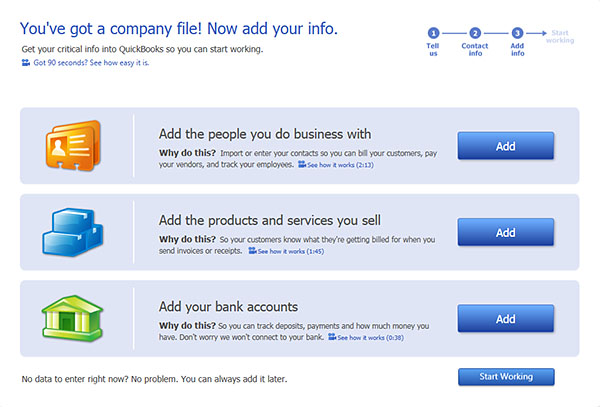

Activating Sales Tax in QuickBooks

If you're collecting sales tax, your active company file is already set up for it. Here is a refresher on how to turn on sales tax in our "Dummy" company:

1.In QuickBooks, go to Edit > Preferences.

2.Click Sales Tax in the list on the left, then click the Company Preferences tab.

3.Where it says "Do you charge sales tax?", enter Yes.

4.Click the Add Sales Tax Item button.

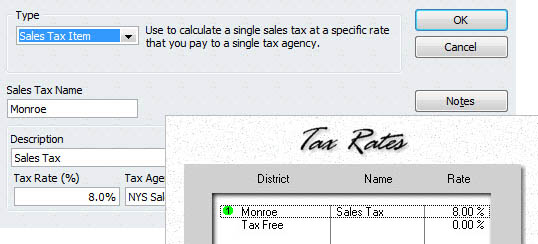

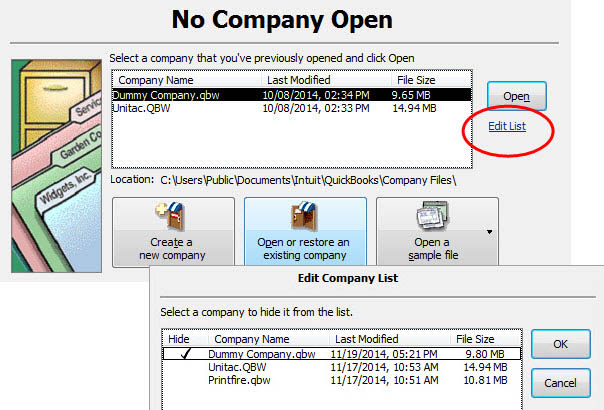

5.Enter a sales tax item matching the name and tax rate of your most common District in Morning Flight (where you'll find it under File > Update Taxes). Note that the "Sales Tax Name" in QuickBooks corresponds to "District" in Morning Flight, and the QuickBooks "Description" to Morning Flight's "Name".

6.Assign Sales Tax Codes. Unless you have good reason not to, accept the QuickBooks defaults. One good reason not to would be because you're using different Sales Tax Codes in your active company file. In that case, use the active file codes for the dummy too, but be sure to adjust the corresponding settings in tab 2 of your Morning Flight QuickBooks Preferences so they'll match.

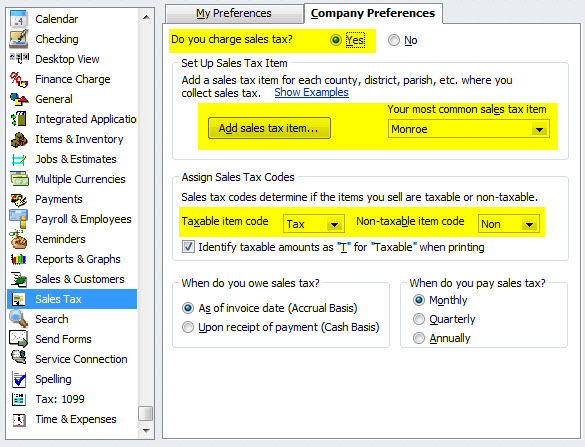

Setting up the Transaction Pro 5 Importer

What follows are basic setup instructions for using the Transaction Pro 5 Importer with Morning Flight invoices.

1.Download the Transaction Pro 5 Importer Demo and install it, but don't run it yet.

2.Open the QuickBooks dummy company file you set up in the previous chapter.

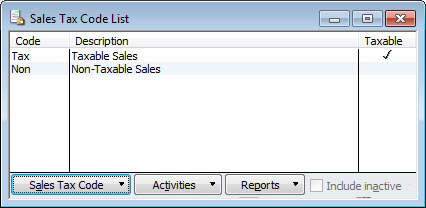

3.Start the Transaction Pro Importer. A window will open in QuickBooks, asking for access to the dummy company. Select “Yes, whenever this QuickBooks company file is open.” Click Continue on this window and Done on the next, the one showing your Access Confirmation.

![]()

Some quick facts about the demo: It's fully functional and has no expiration date, giving you plenty of time to evaluate how well your transfers are working. You'll discover that invoice dates, while real in Morning Flight, will be arbitrary and random in QuickBooks. You'll have to page through the invoice file to locate them. Needless to say, that only happens in the demo.

4.When the main Transaction Pro 5 window opens, click Cancel to exit the importer.

5.Close the dummy company file and exit QuickBooks.

Going Live

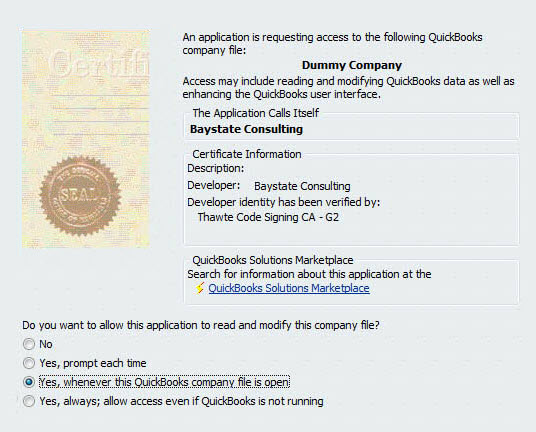

When you're ready to import invoices into your active company file, simply hide the dummy company until you want to practice again:

1.Close the dummy company file.

2.Click Edit List in the window below.

3.In the "Edit Company List" window, highlight the dummy company and click OK. To make it accessible again later, click the "Open or restore an existing company" button.

Transferring Invoices into QuickBooks

Importing Customers from QuickBooks